Introducing Coupe Health

Dec. 2, 2025

Beginning Jan. 1, 2026, BlueCross BlueShield of South Carolina is excited to introduce Coupe Health, a new option for self-insured employers and their employees. Coupe Health is designed to make health care simpler and more predictable by helping members easily find high-quality providers and see costs upfront. With this guided experience, members can feel confident in their choices while saving both time and money.

How is Coupe Health different than other products and networks?

Coupe Health members will be part of our Preferred Provider Organization (PPO) Network, giving them access to a wide range of participating providers. When searching for care, members can use an easy phone or web application to compare providers based on quality, location and copay options. Providers are selected with three key factors in mind—quality, appropriate care, and cost—so members can feel confident in their choices. Plus, there’s no need to worry about paying out-of-pocket costs at the time of service.

The Different Coupe Health Models

Couple Health gives members two flexible options:

Finance Model: Members receive one simple monthly bill from Coupe Health. They can spread payments out over time directly with Coupe Health, while providers are reimbursed in full for covered services. Providers will also get a 27x transaction confirming the member’s eligibility and that no payment is due at the time of service.

Non-finance Model: Members continue to receive bills directly from providers but won’t owe anything at the time of service. Instead, the provider waits until the final claim is processed before billing the member for any liability. Providers are reimbursed at 100% of the allowed amount (minus the member’s share, if applicable). Just like the finance model, the 27x transaction confirms eligibility and lets providers know no payment is due upfront.

270/271 response for a member in a Non-Finance Model plan will contain the message: “No member payment due at time of service, member responsibility is reflected on the final remit file.”

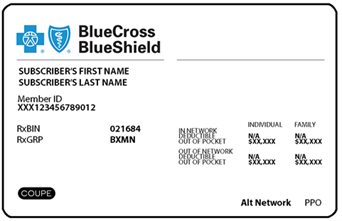

Sample ID Card:

Filing Claims

For members seeing providers in South Carolina, providers should send claims directly to BlueCross BlueShield of South Carolina (as they do today) as local claims. These will be priced using the South Carolina provider agreement so the member’s benefits can be applied correctly.

For members seeing providers outside South Carolina (including those in contiguous counties), claims should be submitted to the local Blue plan as BlueCard claims. The local plan will price the claims based on their provider agreement, then forward them to BlueCross BlueShield of South Carolina to apply the member’s benefits.

BlueCross BlueShield of South Carolina will handle all aspects of claims management—such as medical policy, prior authorizations and reconsiderations.

When checking benefits, eligibility and authorization requirements, providers should always include the appropriate prefix, so the request is routed correctly.

Provider Reconsiderations

If a claim is denied and you’d like to exercise your one-time courtesy review, you can submit a provider reconsideration to BlueCross BlueShield of South Carolina. Please remember to include the Provider Reconsideration Form along with supporting documentation that shows medical necessity, so we can process your request as smoothly as possible. The form includes the fax and mailing details for submission.

Prior Authorizations

Prior authorization requirements may differ depending on the type of service. To avoid any delays, please check eligibility and benefits before providing care to make sure the right authorizations (if applicable) are in place.

Authorizations can be requested using My Insurance Manager℠, which will guide you directly to Cohere Health, the easy-to-use platform for managing authorizations. Providers may receive an immediate response or approval. If a request is pended, a BlueCross BlueShield of South Carolina clinical team member reviews the request for network, benefits or clinical policy alignment.

Review the available frequently asked questions for more information.

We will be sure to provide additional updates as they come. If you have any questions about this bulletin, feel free to contact your Provider Relations Consultant.